-

Raleigh, NC Car Accident

-

How much does it cost to hire a car accident lawyer in Raleigh, NC?The cost of hiring a car accident lawyer in Raleigh, NC can vary depending on several factors, including the complexity of your case and the lawyer's fee structure. Many personal injury attorneys work on a contingency fee basis, which means they only get paid if they win your case. Typically, their fee is a percentage of the compensation you receive. This percentage can range from around 33% to 40%, but it can vary based on the attorney and the specific agreement you reach. It's essential to discuss the fee structure with your attorney during your initial consultation.

-

Will I have to go to court for a car accident case in Raleigh, NC?Whether your car accident case in Raleigh, NC goes to court depends on various factors, including the specifics of your case and whether a settlement can be reached. Most car accident cases are resolved through negotiations and settlements, and court litigation is not always necessary. Your attorney will work to achieve the best possible outcome for you, which may involve negotiations with insurance companies or the other party involved in the accident. Going to court is generally a last resort when a settlement cannot be reached through negotiation.

-

How long will my car accident case in Raleigh, NC take to resolve?The time it takes to resolve a car accident case in Raleigh, NC can vary widely. Some cases can be settled relatively quickly, while others may take much longer, especially if they go to court. The timeline may depend on factors like the severity of the injuries, the complexity of liability issues, and the willingness of the involved parties to negotiate. On average, it might take several months to a couple of years to reach a resolution. It's essential to consult with a qualified car accident attorney in Raleigh, NC, who can provide a more accurate estimate based on the specific details of your case.

-

-

Greensboro Car Accident

-

How much does it cost to hire a car accident lawyer in Greensboro, NC?The cost of hiring a car accident lawyer in Greensboro, NC, can vary depending on several factors, including the attorney's experience, the complexity of your case, and the fee structure they use. Many car accident lawyers work on a contingency fee basis, which means they only get paid if you win your case. Their fees are typically a percentage of the settlement or court-awarded damages. Common contingency fees range from 33% to 40% of the final settlement amount, but these percentages can vary.

-

Will I have to go to court for a car accident case in Greensboro, NC?

Depending on the specific circumstances of your case, you may need to go to court for a car accident case in Greensboro, NC. Many car accident claims are settled through negotiations with insurance companies, and court appearances are not necessary. However, if an agreement cannot be reached, or if liability and damages are in dispute, it may be necessary to file a lawsuit and go to court. Your attorney can guide you through this process.

-

How long will my car accident case in Greensboro, NC take to resolve?The duration of a car accident case in Greensboro, NC can vary widely, depending on factors like the complexity of the case, the extent of injuries and damages, and whether the case goes to court. Some cases may be resolved within a few months, while more complex cases could take a year or more. It's important to consult with a Greensboro car accident attorney who can provide a more accurate estimate of the timeline based on the specifics of your case. They can help you understand the potential duration and steps involved in the legal process.

-

-

Fayetteville Car Accident

-

How much does it cost to hire a car accident lawyer in Fayetteville, NC?The cost of hiring a car accident lawyer in Fayetteville, NC, can vary depending on several factors, including the complexity of your case, the attorney's experience, and their fee structure. Many car accident lawyers work on a contingency fee basis, meaning they only get paid if you win your case. Typically, they'll take a percentage (often around 33-40%) of the final settlement or court award. This fee structure allows individuals to seek legal representation without paying upfront fees.

-

Will I have to go to court for a car accident in Fayetteville, NC?Whether or not your car accident case in Fayetteville, NC, goes to court depends on various factors, such as the severity of the accident, the extent of the injuries, the liability of the parties involved, and the willingness of the insurance companies to settle. Many car accident cases are resolved through negotiation and settlement without going to court. However, if a fair settlement cannot be reached, it may be necessary to file a lawsuit and go to court to seek compensation.

-

How long will my car accident case in Fayetteville, NC take to resolve?The duration of your car accident case's resolution in Fayetteville, NC, can also vary widely. Simple cases with clear liability and minimal damages may be resolved relatively quickly, while more complex cases involving serious injuries and disputed liability can take several months or even years to reach a resolution. Your attorney will be able to provide a more accurate estimate based on the specifics of your case.

-

-

Charlotte, NC Car Accident

-

How much does it cost to hire a car accident lawyer in Charlotte, NC?

The cost of hiring a car accident lawyer in Charlotte, NC, can vary depending on several factors, including the attorney's experience, the complexity of your case, and the fee structure they use. Many car accident lawyers work on a contingency fee basis, which means they don't charge you upfront fees. Instead, they take a percentage of the settlement or award you receive if they win your case. This fee typically ranges from 33% to 40% of the final settlement, but the specific percentage can vary from one attorney to another.

In North Carolina, there's also a cap on attorney fees for personal injury cases, including car accidents. The North Carolina State Bar sets this cap, and it's typically 33.33% of the total recovery. This fee structure is designed to ensure that a significant portion of your compensation goes to you rather than to attorney fees.

-

Will I have to go to court for a car accident?

Whether or not your car accident case goes to court depends on several factors:

Negotiation with Insurance Companies: In many cases, car accident claims are settled out of court through negotiations with the insurance company. Your attorney will work to secure a fair settlement without the need for litigation.

Liability and Damages: If liability (who is at fault) is disputed, or if the insurance company offers an inadequate settlement, your attorney may recommend going to court to pursue a lawsuit.

Desire to Avoid Court: Many car accident cases are settled out of court to save time, money, and stress. Going to court can be a lengthy and costly process, and both parties often prefer to avoid it.

The time it takes to resolve a car accident case can also vary widely and depends on several factors:

Severity of Injuries: Cases involving more severe injuries often take longer to resolve because they may require extensive medical treatment and evaluations.

Complexity of Liability: If there is a dispute over who is at fault, it can prolong the case.

Insurance Company Cooperation: Some cases can be resolved quickly if the insurance company is cooperative and offers a fair settlement, while others may require legal action.

Court Proceedings: If your case goes to court, it can add significant time to the resolution process.

-

How long will my car accident case take to resolve?

It's challenging to provide an exact timeframe for case resolution, as it varies from case to case. Your attorney will be able to provide a more accurate estimate based on the specifics of your situation.

If you've been involved in a car accident and are considering legal representation, it's advisable to consult with an experienced car accident attorney in Charlotte, NC. They can provide guidance on your specific case, the potential timeline, and the costs associated with their services.

-

-

Charlotte Personal Injury

-

How Do I Know If I Have a Case?If you suffered an injury that wasn't your fault, you may have a case for a personal injury claim. The essential elements of a personal injury claim involve a duty of care being owed to you by the defendant (person who caused your injury), the violation of that duty, and the damages you sustained as a direct result of the defendant's actions (or inaction). However, every personal injury case is unique and we encourage you to schedule a free case evaluation with our office so that we can fully explain your rights.

-

How Much is My Case Worth?The "value" of a personal injury case is usually directly related to the severity of the injury and extent of damages sustained by the victim. Someone who sustained a traumatic brain injury will typically suffer more financial and emotional losses than someone who suffered a broken arm. However, there are numerous elements that need to be evaluated before an approximate value can be attributed to your case, so it's crucial that you speak to an attorney before accepting an offers from the negligent party or their insurance company.

-

Will My Personal Injury Case Go to Court?Your personal injury case could go to court for trial, but it almost might not. Every case is unique, so it can be difficult to predict which cases will go to court or not. Historically, most legitimate personal injury claims are settled out of court, though. During an initial consultation, we can give you an honest idea if your claim has a good chance of settling, but our commitment to practice ethics means that we can’t make any promises one way or the other.

-

What Information Should I Bring for My Initial Consultation?Any relevant information that you can bring to an initial consultation is worth it. From medical records related to your injury to pictures that you took with your smartphone, it is helpful for our personal injury lawyers to see it all. Using this information, we can determine early if your case should be pursued and what to do next if it should.

-

Who Will I Be Working With?Lanier Law Group is proud to give each client access to an entire team of legal professionals. Although paralegals and legal secretaries will help manage your case, you don’t have to worry about it being handled just by them. An attorney assigned specifically to your case will work on it, too, and keep you updated, so you never feel like you’re left in the dark.

-

-

Uninsured and Underinsured Motorist Coverage

-

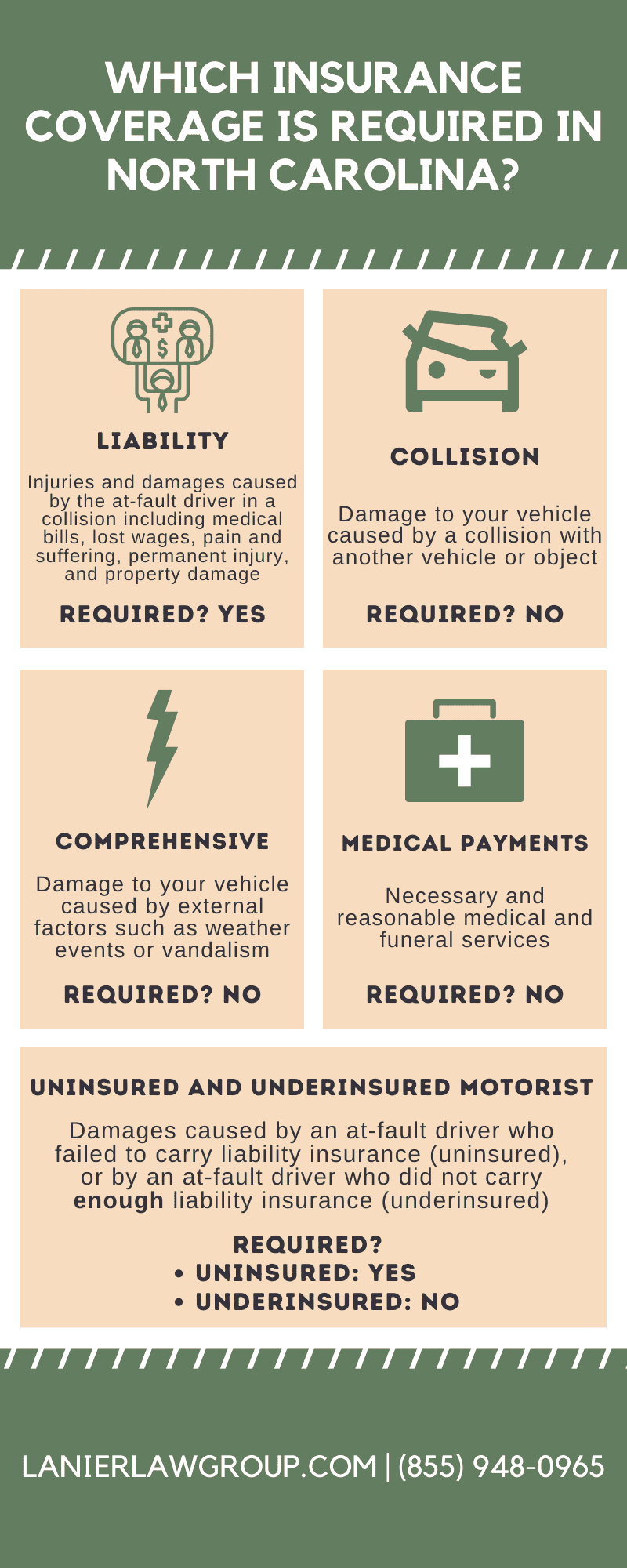

What Are North Carolina’s Car Insurance Requirements?

North Carolina requires every driver to carry liability coverage. The liability insurance requirements are as follows:

- Bodily injury (one person): $30,000

- Bodily injury (two or more people): $60,000

- Property damage: $25,000

Uninsured motorist coverage is also required in North Carolina. In this state, liability coverage and uninsured motorist coverage are a package deal. Drivers receive $30,000 in uninsured motorist coverage when they purchase $30,000 in liability. Underinsured motorist coverage, however, is optional and must be added to a policy.

-

Other Types of Optional Insurance Coverage

In North Carolina, uninsured motorist coverage is included with $30,000 in liability coverage while underinsured motorist coverage is an optional add-on.

There are several other types of coverage that are optional. These include the following:

- Collision coverage: This pays for damage to your vehicle caused by a collision with another vehicle or object. You would pay for the cost of repairs up to your deductible (usually anywhere between $500 and $2,000), and then your insurance company would pay the rest.

- Comprehensive coverage: This pays for damage to your vehicle caused by external factors such as weather events or vandalism. Again, you would pay for the cost of repairs up to your deductible, and then your insurance company would pay the rest.

- Medical payments coverage: This pays the medical expenses incurred by you or others riding in your car due to medical treatment required because you were in a collision. Called “Medpay,” this coverage is typically sold to North Carolinians in amounts ranging from $250 to $1 million. The most common amounts range between $500 and $5,000.

-

What’s the Difference Between Uninsured and Underinsured Motorist Coverage?The main difference between uninsured and underinsured motorist coverage is that uninsured motorist coverage pays for injuries and damages caused by a driver who has no insurance at all, while underinsured motorist coverage pays for injuries and damages caused by a driver whose liability insurance coverage is too low to pay for the injuries and damages they caused.

-

How Many Drivers Are Uninsured?

The number of people who drive without insurance is startling. According to the Insurance Information Institute (III), approximately 13% of drivers in the United States do not have car insurance. In North Carolina specifically, approximately 6.5% of motorists drive without insurance.

Some states have taken measures to reduce the negative effects of uninsured drivers on the road. Twenty states and the District of Columbia now require all motorists to carry uninsured and/or underinsured motorist coverage. Additionally, more than half of the states have passed laws and started to develop online car insurance verification systems to identify uninsured drivers.

-

When is a Vehicle Considered Uninsured?

North Carolina’s Motor Vehicle Safety and Financial Responsibility Act of 1953 (MVSFRA) states that a vehicle is considered “uninsured” if it has no bodily injury liability insurance and property liability insurance in at least the minimum limits required by state law, or that there is such insurance, but the insurance company writing the policy denies such coverage or has become bankrupt.

The only vehicles excluded from the term “uninsured motor vehicle” include:

- A motor vehicle owned by the named insured;

- A motor vehicle that is owned or operated by a self-insurer within the meaning of any motor vehicle financial responsibility law, motor carrier law, or any similar law;

- A motor vehicle that is owned by the government;

- A land motor vehicle or trailer if operated on rails or crawler-treads or while used as a residence and not as a vehicle; or

- A farm-type tractor or equipment designed for use off public roads, except while actually on public roads.

-

When is a Vehicle Considered Underinsured?According to the MVSFRA, a vehicle is considered “underinsured” if the sum of the limits of liability under all bodily injury liability insurance policies applicable at the time of the crash is less than the limits of underinsured motorist coverage for the vehicle involved in the collision and insured under the owner’s policy.

-

Who is Covered Under an Underinsured Motorist Policy?

An underinsured motorist policy does not only cover the policyholder. Under the MVSFRA, underinsured motorist coverage also applies to the following individuals:

- While a resident of the same household, the spouse of any named insured, and relatives of either, while in a motor vehicle or otherwise;

- Any person who uses with the consent, expressed or implied, of the named insured, the motor vehicle to which the policy applies;

- A guest in the motor vehicle to which the policy applies;

- The personal representative of any of the above; or

- Any other person or persons in lawful possession of the motor vehicle.

-

What Does an Uninsured and Underinsured Motorist Policy Cover?Uninsured and underinsured motorist coverage can pay for injuries and damages from a wreck caused by a driver who does not have insurance (uninsured) or does not have enough insurance to pay for the full cost of the injuries and damages (underinsured).

-

What About a Hit-And-Run Collision?

Uninsured motorist coverage may pay for injuries and damages caused in a hit-and-run collision in certain circumstances. These requirements are intended to prevent fraudulent claims.

First, the insured individual must report the hit-and-run collision to law enforcement within 24 hours to allow for an investigation of the crash. If the insured individual fails to report the collision, they will not receive any compensation under their uninsured motorist policy.

Second, the insured individual must notify their insurance company of the claim “within a reasonable time.”

Third, the collision must involve contact between vehicles. Any collision without contact is not covered. This is also known as the “no contact rule.” For example, if a vehicle is run off the road by another, but no contact between the two vehicles occurred, uninsured motorist coverage will not be liable and can, therefore, be denied, according to the North Carolina courts.

This process may seem intimidating and overwhelming, particularly if you are focused on recovering from your injuries after an accident. This is why it’s in your best interest to contact one of our experienced personal injury attorneys who can take the matter out of your hands. We operate on a contingency fee basis, which means you do not owe us anything unless we recover money for you. So, there is no downside to giving us a call at (855) 757-4204 or live chatting with our team and learning about your options.

-

Unique Situations Where Uninsured and Underinsured Motorist Coverage Would Apply

Although uninsured and underinsured motorist coverages most often apply when a motorist makes contact with a vehicle whose driver does not have insurance, there are also other circumstances where uninsured and underinsured motorist coverage could pay for injuries and damages.

According to the MVSFRA, any uninsured and underinsured motorist policy shall insure the named insured against loss “for damages arising out of the ownership, maintenance, or use of such motor vehicle.” In short, any time an insured individual is injured while using their vehicle (even if they are not driving the vehicle at the time), they may be covered under both an uninsured and underinsured motorist policy.

For example, in the case Dutch v. Harleysville Mut. Ins. Co., 139 N.C. App. 602, 534 S.E.2d 262 (2000), a person crawling under their vehicle to attach a chain was “insured” under the underinsured motorist provisions of their policy because they were “occupying” the vehicle and was the “person insured” under N.C. Gen. Stat. §20-279.21(b); thus, the person was entitled to underinsured motorist coverage under their policy. The same also applies to uninsured motorist coverage.

Other unique situations in which you may recover damages under your uninsured and underinsured motorist policy include:

- You were hit by a vehicle while changing your car’s flat tire.

- You were the victim of a pedestrian collision caused by an uninsured driver.

If you do not have your own uninsured or underinsured motorist policy, you may still recover damages from such a policy belonging to someone close to you. Examples of such situations include:

- You live with a relative who has uninsured and underinsured motorist coverage.

- You were driving a vehicle with the owner’s permission, and the owner has uninsured and underinsured motorist coverage.

- You were a passenger in a vehicle with uninsured and underinsured motorist coverage.

-

What Are Uninsured and Underinsured Motorist Coverage Limits?As with other policies, there is a certain maximum amount that your insurer will pay out through your uninsured and underinsured motorist policies.

-

Uninsured Motorist Policy LimitsSince $30,000 in uninsured motorist coverage is included with a driver’s purchase of minimum liability coverage in North Carolina, any driver who has purchased at least the minimum coverage may receive up to $30,000 in collision damages caused by a motorist without insurance. Uninsured motorist coverage may be purchased in greater amounts and the amount of available uninsured motorist coverage depends upon the amount purchased in the insurance contract. A copy of your declarations page will identify the amount of uninsured motorist coverage you purchased.

-

Underinsured Motorist Policy Limits

With underinsured motorist, the liability coverage is primary and must be exhausted before reaching the underinsured motorist coverage. If the liability carrier settles with the claimant for less than the full amount of the liability policy limits, then underinsured motorist coverage is not available.

According to the MVSFRA, the limit of underinsured bodily injury coverage shall be equal to the highest limit of bodily injury liability coverage for any one vehicle insured under the policy. However, this limit shall not exceed $1,000,000 per person and $1,000,000 per collision regardless of whether the highest limits of bodily injury liability coverage for any one vehicle insured under the policy exceed those limits.

The amount of underinsured motorist coverage available is subject to a credit that the underinsured motorist carrier gets to take for the liability coverage. The maximum amount that an underinsured motorist policy can potentially pay out depends on how much coverage you and the at-fault driver actually have. If, for example, you have $50,000 in underinsured motorist coverage, but the at-fault driver only has $30,000 in liability coverage, then your underinsured motorist policy may pay you up to $20,000, since that is the difference between your coverage limits. This is only the case, however, if the damages you sustained from the wreck exceed the at-fault driver’s policy amount ($30,000 in this example).

Additionally, if, in the previous example, you instead have $50,000 in underinsured motorist coverage and the at-fault driver has $50,000 in liability coverage, then you would not collect any credit from your own underinsured motorist policy, since there is no difference between the amount the at-fault driver can pay and the amount you need.

In short, an underinsured motorist policy only applies when the damages from the collision are enough to exhaust the limits of the at-fault driver’s liability policy. The underinsured motorist carrier is also entitled to a credit for medical payments coverage paid under the same policy.

If you settle with the liability carrier and execute a general release, you are also releasing the underinsured motorist carrier and your claim will be worthless. You must insist that the liability carrier use a special type of release called a “Covenant Not To Enforce Judgment.” The liability carrier has no duty to protect or preserve your underinsured motorist claim and may send you the fatal general release. The guidance of an attorney can be critical at this point.

-

Can You Stack Uninsured and Underinsured Motorist Policies?

In the event of a collision caused by an uninsured or underinsured motorist, the innocent party may be covered by more than one uninsured or underinsured motorist policy. This is also known as policy “stacking.”

There are two main forms of policy stacking, including the following:

- Interpolicy stacking: The innocent party may fit the definition of “insured” on more than one policy.

- Intrapolicy stacking: The innocent party may have more than one vehicle covered by one policy.

In 2004, the North Carolina legislature prohibited intrapolicy stacking of uninsured and underinsured motorist coverage in the event of a crash. However, interpolicy stacking is permitted.

In summation, the MVSFRA was amended to state that:

“...The maximum amount payable under all applicable policies for injuries to an insured person caused by an uninsured motor vehicle shall be the sum of the highest limit of liability for this coverage under each such policy.”

-

When Is Interpolicy Stacking Not Permitted?

Under North Carolina law, interpolicy stacking applies only to insurance on “nonfleet private passenger motor vehicles as described in N. C. Gen. Stat. §58-40-15 (9) and (10).”

Additionally, any uninsured and underinsured motorist coverage provided in a policy of insurance covering five or more vehicles or covering a vehicle which does not meet the statutory definitions of a “private passenger motor vehicle” would not qualify as a “separate or additional policy” and its limits could not be “stacked” on any other policies in determining the uninsured and underinsured motorist limit.

-

Filing an Uninsured and Underinsured Motorist Claim

If you have been in a wreck caused by a driver with no insurance coverage or too little insurance coverage to pay for the full cost of injuries and damages, you will file a claim with your own insurance company through your uninsured and underinsured motorist policy.

However, as mentioned previously, even your own insurance company is more interested in preserving its profits than paying you the compensation you deserve.

Additionally, it’s important to remember that, in North Carolina, you cannot sue your insurance company. Rather, the matter will be submitted to arbitration.

In arbitration, one or more arbitrators will hear your case and decide on the outcome. In most cases, this decision is binding.

Both of these reasons illustrate why it’s important for you to work with an experienced personal injury attorney throughout this process so you have the best possible chance of recovering the compensation you deserve.

-

Is There a Deadline to File an Uninsured and Underinsured Motorist Claim?

As with most collision claims, there is a deadline to file an uninsured and underinsured motorist claim. This is also known as the statute of limitations. In North Carolina, claimants generally have three years from the date of the collision to file.

Filing a claim can be complicated, and you do not want to run into the situation where you cannot recover the compensation you deserve because the deadline has passed. This is why you should work with a qualified personal injury attorney who can resolve your claim more efficiently.

-

What Happens if Uninsured and Underinsured Motorist Coverages Do Not Pay for the Full Cost of the Collision?

Uninsured and underinsured motorist coverage is designed to cover you for injuries and damages caused by an at-fault driver when they have insufficient insurance coverage (or none at all). It’s similar to a “back-up plan” in the event of a crash, because you will be covered no matter what. However, the amount you recover will depend on the amount of coverage you purchased. So, if you have $30,000 in uninsured and underinsured motorist coverage, for example, the maximum amount you could recover from your insurer would be $30,000.

In North Carolina, you may be able to recover compensation for a wide variety of losses depending on the type and amount of coverage you purchase. These include:

- Past and future medical bills for you as a driver, as well as for your family members or anyone in your car

- Past and future medical bills when you are a passenger

- Repairs to your car

- Lost wages

As we have discussed, North Carolina requires drivers to carry at least the following mandatory minimum insurance levels:

- Bodily Injury: $30,000 for one person, $60,000 for two or more people;

- Property Damage: $25,000.

Since all North Carolina drivers get uninsured motorist coverage included with liability coverage, your uninsured motorist policy could pay you up to $30,000 for damages caused by a driver with no insurance (if you have the minimum required coverage).

If your damages were caused by a driver with insufficient insurance coverage, your underinsured motorist policy (if you have one) can pay the difference between the other driver’s liability limits and your underinsured motorist policy limits. So, if a driver with insufficient insurance causes a collision that results in $30,000 in medical bills for you, but they can only pay $15,000, your own insurance company could pay you $15,000 under your underinsured motorist policy.

But, what happens if your medical bills exceed $30,000 in this situation? With the help of an experienced personal injury attorney, you may be able to pursue one of the following courses of action:

- File a civil lawsuit against the at-fault driver. If an uninsured driver negligently causes a collision, it may be possible to file a civil lawsuit against them for additional damages not covered under your own uninsured and underinsured motorist policy. However, it’s important to remember that there is no guarantee that an uninsured driver will have sufficient assets to cover any judgement in a civil lawsuit, and so this may not be the best course of action. However, make sure to speak with a qualified attorney first before making that decision.

- Identify product defects. It is possible that human error did not cause the collision. Manufacturers of defective auto parts may be held liable for collisions that were caused by one of their components. Such product defects may include tires blowing out, steering wheels sticking, and more.

- Determine whether government entities were responsible. Government entities may be held liable for collisions caused by roadway defects or traffic light malfunctions. In such instances, it is possible that one of these issues caused an uninsured driver to crash into you.

- See whether a rideshare insurance policy applies. If you were involved in a collision caused by a rideshare vehicle (such as Uber or Lyft), you may be covered by these companies’ $1 million commercial insurance policies.

It’s important to remember that you can decide to pursue these courses of action even if the damages you incur do not exceed your policy limits. It is up to you and an experienced personal injury attorney to determine the best direction to take.

In the case that you cannot or should not pursue one of the aforementioned courses of action, it’s important for you to consider the possible consequences of not carrying enough uninsured and underinsured motorist coverage when purchasing insurance. While the minimum required coverage in North Carolina is $30,000 in bodily injury and $25,000 in property damage, you do not need to carry only the minimum amount.

Consider purchasing more than the minimum amount in uninsured and underinsured motorist coverage so that you can avoid getting hung out to dry when your medical bills exceed your policy limits. A good rule of thumb is to purchase at least enough coverage to provide two years’ worth of income. This is because it can take about two years for Social Security Disability approval.

-

My Insurance Company Denied a Legitimate Claim. Now What?

Many of us pay our insurance companies a hefty premium so that we are covered after a crash. Unfortunately, however, insurance companies are notorious for denying legitimate claims and leaving injured people and motor vehicle accident victims in the lurch when they need help the most.

If a claim is legitimate, insurance companies are obligated to provide coverage and uphold the terms of their policy. However, insurance companies often look for any trick in the book they can use to protect their bottom line.

These tactics may constitute insurance bad faith, and can include:

- Deliberately misinterpreting their own policy language to avoid paying a claim

- Causing unreasonable delays to avoid resolution of a claim

- Failing to conduct a thorough investigation of a claim

- Asking the insured person to contribute to the settlement

- Using intimidation or other abusive methods

Insurance companies’ tendency to use these tactics to deny a claim highlight the need to have a strong advocate in your corner to fight for you and protect your best interests. Working with an experienced personal injury attorney greatly increases your chances of getting your claim approved and recovering the compensation you deserve.

-

-

General

-

What can a personal injury attorney do to help me?A North Carolina injury attorney can help by handling your insurance claim and filing a personal injury lawsuit against the person or entity that caused your injuries. By properly handling these actions while also defending your rights, an attorney can seek the full financial compensation to which you may be entitled by law.

-

What will my case be worth?All personal injury claims are different. It is therefore impossible to say what the exact value of your case may be without a complete evaluation of the injuries you sustained, medical bills involved, lost wages, and more.

-

What will it cost to work with your firm?There are no out-of-pocket expenses when you work with an injury attorney at our law offices. We work on a contingency fee basis, which means we do not charge any legal fees unless we win your case. Your initial consultation is also free with our North Carolina injury attorneys!

-

Will I have to appear in court?Less than 5% of personal injury cases end up going to trial. The team at Lanier Law Group is usually able to secure a favorable settlement from the liable party without going to court. However, if the other party refuses to offer a settlement that is high enough to cover our client's current and foreseeable expenses, we are ready and able to take the case to court. Our heavy-weight personal injury lawyers in North Carolina have won many jury verdicts on behalf of our clients in North Carolina courts.

-